PORTFOLIO SELECTION AND MANAGEMENT USING A HYBRID INTELLIGENT AND STATISTICAL SYSTEM

DOI:

https://doi.org/10.33017/RevECIPeru2004.0010/Keywords:

Genetic Algorithms, Neural Networks, GARCH, VaR, Volatility.Abstract

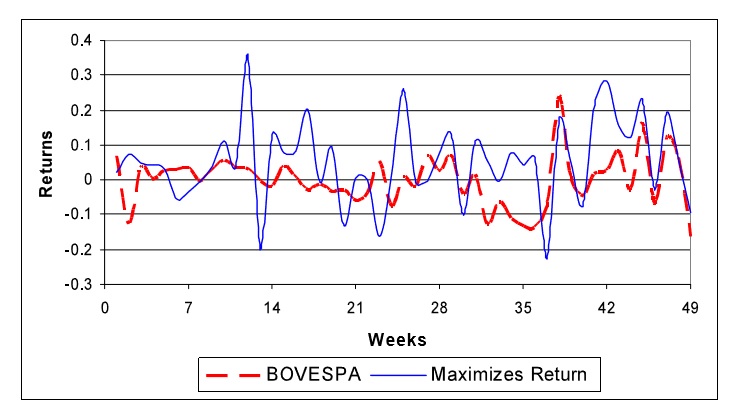

This paper presents the development of a hybrid system based on Genetic Algorithms, Neural Networks and the GARCH model for the selection of stocks and the management of investment portfolios. The hybrid system comprises four modules: a genetic algorithm for selecting the assets that will form the investment portfolio, the GARCH model for forecasting stock volatility, a neural network for predicting asset returns for the portfolio, and another genetic algorithm for determining the optimal weights for each asset. Portfolio management has consisted of weekly updates over a period of 49 weeks.

Downloads

Published

2019-01-04

Issue

Section

ARTÍCULOS ORIGINALES